Employee Provident Fund EPF Interest Rate 2015-16. I have resigned my previous employer in March 2016 and joined new firm and got UAN generated in new company.

Confluence Mobile Community Wiki

Your employers contribution to your EPF is also tax-free.

. Total monthly contribution RM2300. Click on the lower right button and back to the classic. But from now onwards it includes BasicDAAllowances.

For newly implemented areas the contribution rate is 1 and 3 respectively for employee and employer for the first 24 months. The fund is built with monetary contributions extended by employees and their employers each month. When calculating interest the interest applicable per month is 81012 0675.

BEPF is a great way to get someone other than yourself namely your employer to contribute to your retirement. Employees Provident Fund- Contribution Rate. And the best part is that the money.

The scheme is managed under the aegis of Employees Provident Fund Organisation EPFO. The interest rate for 2021-2022 is 810. Apply as if the rate of contribution which such employer or employee has elected to pay were the rate respectively set out in the Third Schedule.

There are many advantages of EPF Self Contribution. In the year 2016 or 2017 EPF introduced a few changes employees started thinking that if they dont contribute for 3 years they will not get interest on the balance amount. Must Read Pension Plans for NRIs in India Inoperative EPF Account Confusion.

EMPLOYEES PROVIDENT FUND ACT 1991. Contributions for a particular month will be eligible for dividend based on the last day of the contribution month until 31 December 2021. Independent India 75.

The EPF MP Act 1952 was enacted by Parliament and came into force with effect from 4th March 1952. However the contribution can also be done on higher wages ie. The EPF interest rate for the fiscal year 2022-23 is 810.

Previously as the meaning of salary was only BasicDA so 12 of Rs30000Rs3600 was considered for EPF payout from your end and equally from your employer end too. The interest earned on the EPF Account balance every year is tax-free. EPF contribution for both employee and employer is calculated on the basis of your BASICDA ie.

Both parties extend 12 each of the employees monthly salary as their share of contribution towards EPF. Employees Provident Fund Amendment Act 2016 - Sections 2 4 12 16 19 23 paragraphs 24b and c of the Act comes into operation on 01042016. Employer share will.

The dividend rate of the EPF is always higher than Fixed Deposit Rate provided by bank. This amount BASIC DA is capped at INR 15000. EPF Interest Rates 2022 2022.

About Employees Provident Fund Organisation. As per paragraph 606 of EPF. But in July 2017 Ministry of Labour Employment issued a clarification.

Those employees whose daily average wage is Rs 137 as these employees are exempted from own contribution The employer is required to pay his contribution 8 Rate of Employers Contribution. So your total salary from above example will be Rs46000. Contribution to EPF will be 12 of Rs46000 which is.

Above 15000 by submitting a joint request from Employee and employer as required in Para 266 of EPF Scheme. The fund thus built accrues a pre-fixed rate of interest that has been set by the Employees Provident Fund Organisation. EPF is the main scheme under the Employees Provident Funds and Miscellaneous Provisions Act 1952.

When the EPFO announces the interest rate for a fiscal year and the year closes the interest rate is computed for the month-by-month closing balance and then for the entire year. In other words if your BASIC DA exceeds INR 15000 the maximum EPF contribution will not exceed INR 1250. 2016 dividend and earlier the EPF Shariah Advisory Committee SAC has resolved that the dividend purification is.

We have no choice to get rid of EPF deduction. Employee Provident Fund EPF Interest Rate 2014-15. A series of legislative interventions were made in this direction including the Employees Provident Funds Miscellaneous Provisions Act 1952.

As an employee working in a corporate set-up there are several things one would like to know about the Employees Provident Fund EPF. The reduction in statutory rate of EPF contributions from 12 to 10. Last Date for registration under ABRY is 31032022.

The interest rate on EPF is reviewed on a yearly basis. Step By Step Pay EPF Online. As per the Employee Provident Fund rules the employer contributions are payable on maximum wage ceiling of 15000.

Other incentives are very low for us. Employee Provident Fund EPF Interest Rate 2016-17. Register now by logging on to EPFO Employer Portal There is no last date for updating e-nomination.

Employers contribution towards EPF Employees contribution Employers contribution towards EPS 550. Total EPF contribution every month 1800 550 2350. 12 of BASIC DA.

367 to the Employees Provident Fund EPF 050 to the Employees Deposit Linked Insurance EDLI Apart from this the employer has to pay an additional charge of 050 for administrative accounts with effect from 1 June 2018. AEPFs dividends of 45 615 over the past five years are significantly more attractive. Besides we can get tax relief up to RM 6000 under Life insurance and EPF types.

CEPF contribution is that it qualifies for tax deduction by way of personal. The eye opener in the appended link is that a major part of the Employers contribution goes towards the EPS. Any dividends received before Simpanan Shariah is made available to the members ie.

Prosecution under Section 14 of the EPF MP Act 1952 Action under Section 110 of the Criminal Procedure Code and Section 406409 of Indian Penal Code Arrest and Detention of the employer Attachment and sale of properties realisation of the dues from debtors and attachment of bank accounts are some of the actions that can be taken against.

Confluence Mobile Community Wiki

Confluence Mobile Community Wiki

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

20 Kwsp 7 Contribution Rate Png Kwspblogs

Epf Interest Rate Cut To 8 1 Guide To Calculating Pf And Interest Earned Business Standard News

Tds Applicability And Rates Tax Deducted At Source Part 2 Tax Deducted At Source Rate Tax

Estimates Of Smoothed Contribution Rates And Associated Trust Funds Download Table

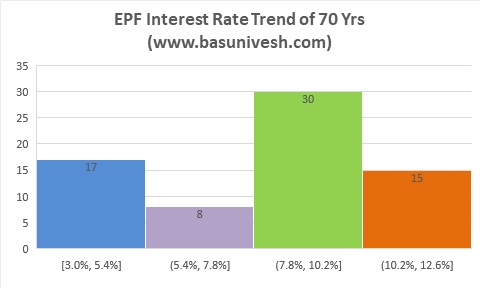

Epf Interest Rate Fy 2021 22 Historical Epf Rates 1952 To 2022 Basunivesh

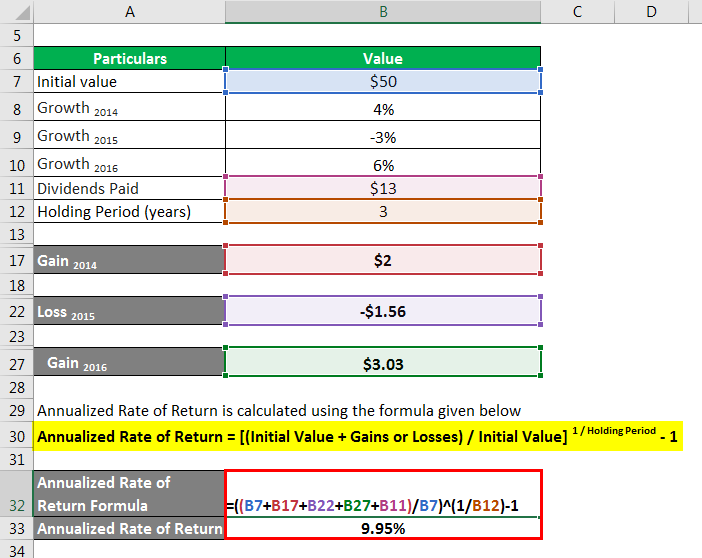

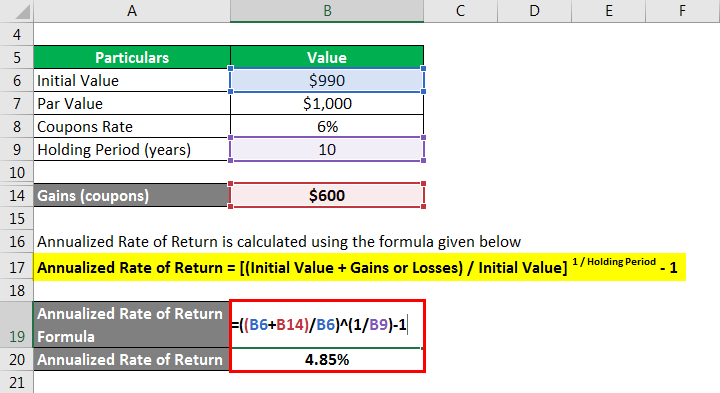

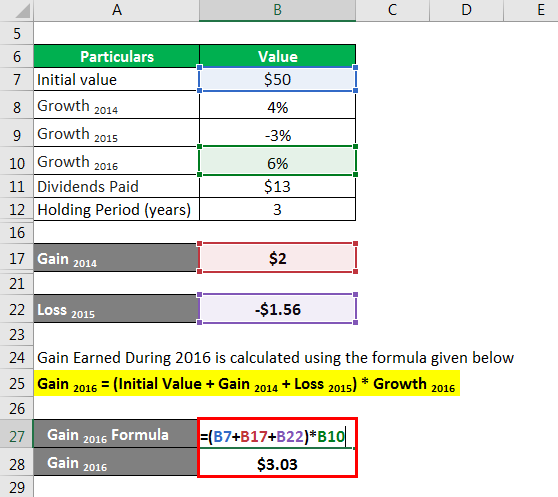

Annualized Rate Of Return Formula Calculator Example Excel Template

Annualized Rate Of Return Formula Calculator Example Excel Template

Confluence Mobile Community Wiki

Pin On Excel Utility To Prepare Ecr Ii

Annualized Rate Of Return Formula Calculator Example Excel Template

Highlighted The Various Break Even Points In Terms Of Deductions In Blue Therefore If Your Actual Deductions Are Greater Than Budgeting Personal Finance Tax

Tds Applicability And Rates Tax Deducted At Source Part 2 Tax Deducted At Source Rate Tax

Cash Management Guidelines Ministry Of Finance Clarification Dtd 17th February 2021 Cash Management Management Finance

Epf Interest Rate From 1952 And Epfo

Confluence Mobile Community Wiki